41+ how much of income should go to mortgage

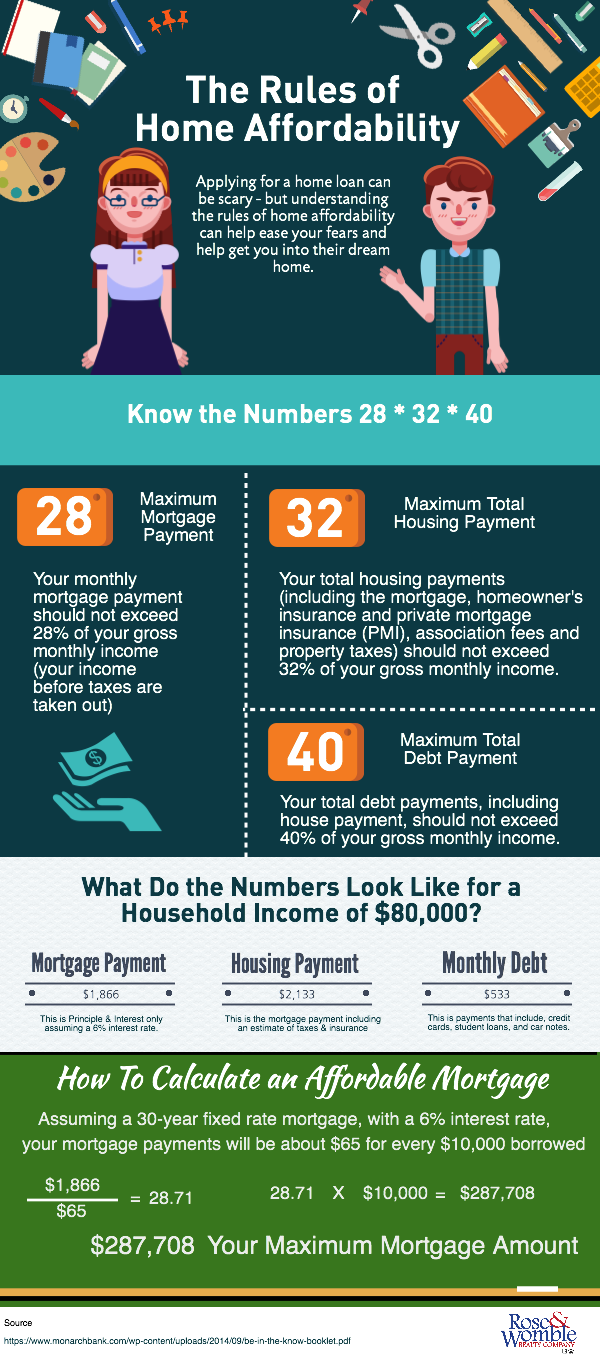

Ad Compare Home Financing Options Online Get Quotes. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

How Much House Can I Afford Insider Tips And Home Affordability Calculator

Apply Today and Get Pre-Approved In Minutes.

. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income or. Get Your Home Loan Quote With Americas 1 Online Lender. Take Advantage of Low VA Loan Rates.

Estimate your monthly mortgage payment. And they see a 28 DTI as an excellent one. Lock In Your Low Rate Today.

Ad See how much house you can afford. Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web Lenders use your debt-to-income ratio DTI as a measure of affordability. Web The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt. Get Your Home Loan Quote With Americas 1 Online Lender.

Web He recommends putting 10 to 20 percent down on your home keeping mortgage payments under 25 percent of your monthly net pay and using a 15-year payoff plan rather than the. Ad How To Get a Mortgage. Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment.

Ideally that means your monthly. A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

And you should make. Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web A common benchmark for DTI is not spending more than 36 of your monthly pre-tax income on debt payments or other obligations including the mortgage you are seeking.

Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Ad Calculate and See How Much You Can Afford. Web 25 Post-Tax Model.

Ad Compare Home Financing Options Online Get Quotes. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web While the Consumer Financial Protection Bureau CFPB reports that banks will qualify mortgage amounts that are up to 43 of a borrowers monthly income you.

Find Out Which Mortgage Loan Lender Suits You The Best. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. John in the above example makes.

Save Time Money. This rule says that you should not spend more than 28 of. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income.

The Percentage Of Income Rule For Mortgages Rocket Money

How Much To Spend On A Mortgage Based On Salary Experian

Percentage Of Income For Mortgage Payments Quicken Loans

956 Fourchu Road Gabarus Lake Mls 202302063 Re Max Nova

How Much Of Your Salary Should You Spend On A Mortgage Calculator

Mortgage Income Calculator Nerdwallet

What Percentage Of Your Income Should Go To Mortgage Chase

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Finance Bowral Mittagong Moss Vale Goulburn Mortgage Choice

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Suggested Net Worth Growth Target Rates By Age

Mortgage School The Rules Of Home Affordability Rose Womble Realty Co

Need A Mortgage Keep Debt Levels In Check The New York Times

Percentage Of Income For Mortgage Rocket Mortgage

What Is A Mortgage Credit Carrots

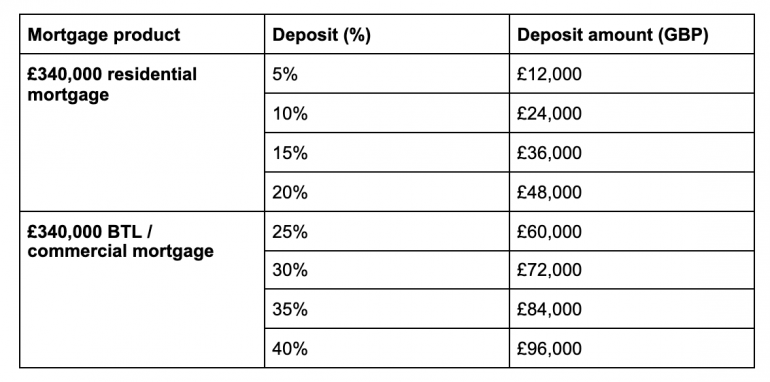

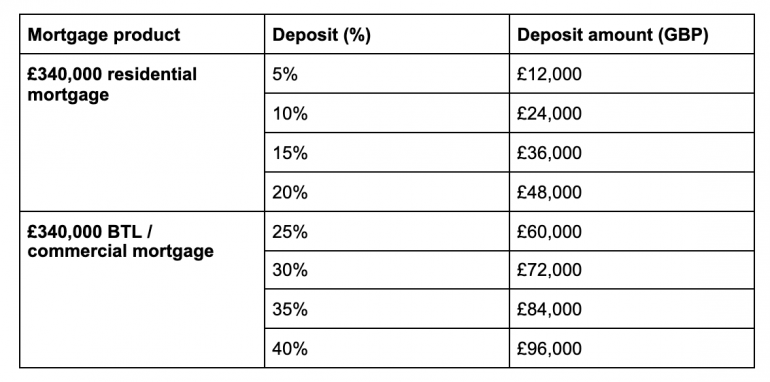

340 000 Mortgages Affordability Eligibility Requirements

How Much House Can You Afford Here S How To Figure It Out Sheknows