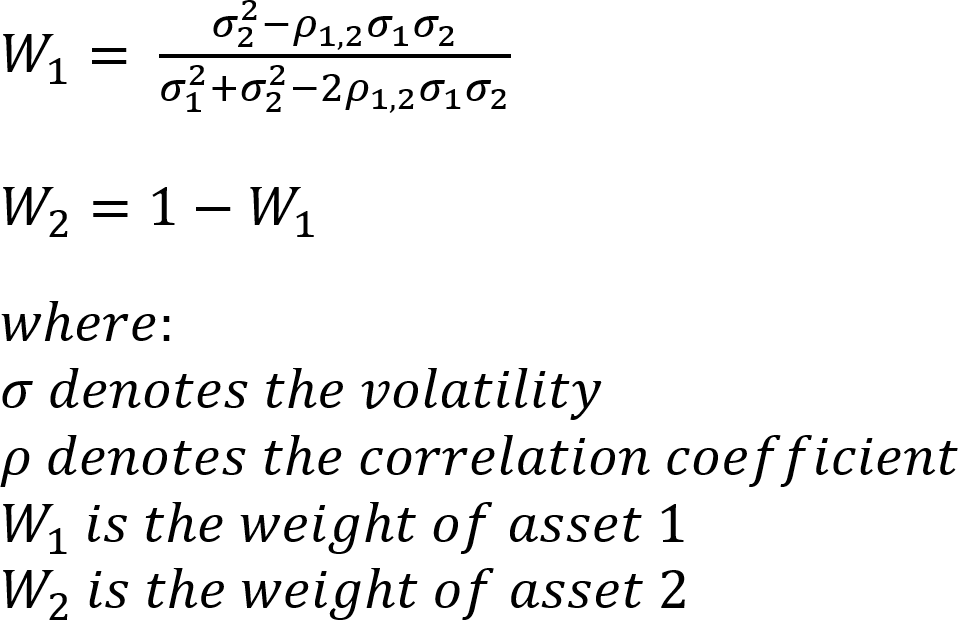

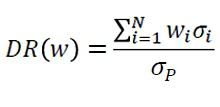

Portfolio diversification formula

Rowe Price Helps You Meet Clients Financial Goals. Rowe Price Helps Investors Find Value In The Undervalued.

How Many Stocks Make Up A Well Diversified Portfolio Seeking Alpha

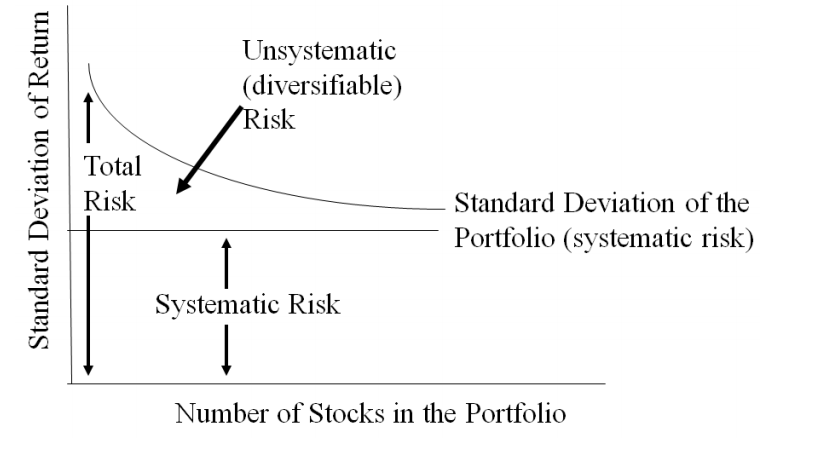

MPT shows that by combining more assets in a portfolio diversification is increased while the standard.

. The portfolio now has the same diversification as a portfolio of three loans of equal size. Diversification is a portfolio allocation strategy that aims to minimize idiosyncratic risk by holding assets that are not perfectly positively correlated. Learn More About How T.

Wi the weight of the ith asset. Correlation is simply the. I have written many times.

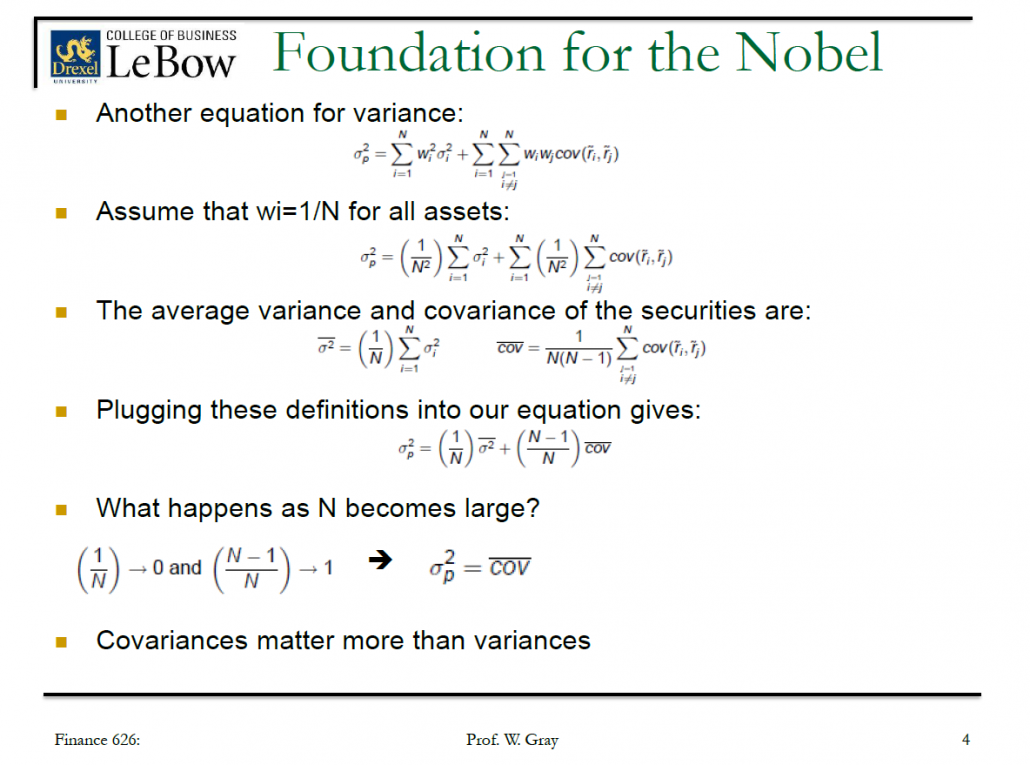

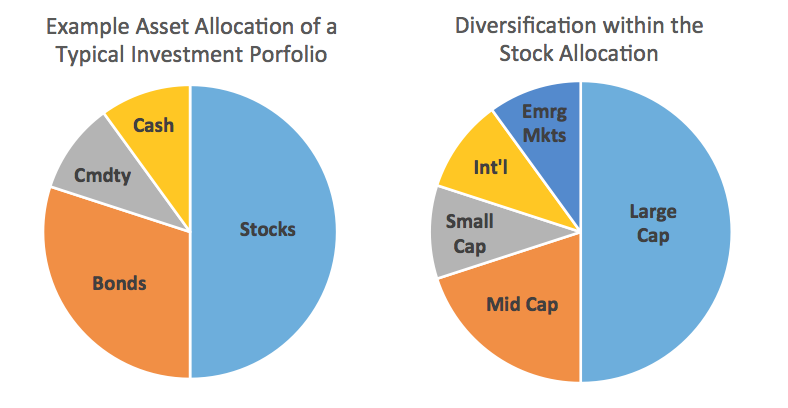

The variance for a portfolio consisting of two assets is calculated using the following formula. Investment Diversification Formula Is There One. In finance diversification is the process of allocating capital in a way that reduces the exposure to any one particular asset or risk.

It is computed with the following formula. To learn more about. Achieving Optimal Diversification to Reduce Unsystematic Risk.

Rowe Price Helps Investors Find Value In The Undervalued. Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Diversification could also be an important consideration for those with company stock options as investing too much in one stock could lead to an unbalanced portfolio. Download our free guide to learn to get the most out of your retirement funds. Formula for Portfolio Variance.

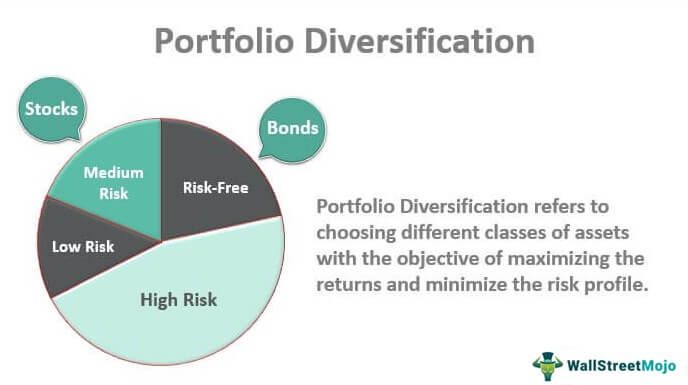

Ad Diversify your portfolio with non-catastrophe low volatility insurance-linked investments. Portfolio diversification is the process of investing your money in different asset classes and securities in order to minimize the. Free 2-hour Trading Workshop and Lab our investing QuickStart Kit Stock Picks more.

When these ETFs are. Too few stocks and one blowup hurts the portfolio by a noticeable amount. VarR p w 2 1 VarR 1.

The volatility for each component is summarized in Figure 2 and the average of these volatilities is 228. Too many stocks and you run the risk of a very expensive index fund. New Look At Your Financial Strategy.

Ad See how Fisher investments can help you reach your goals so you can retire carefree. The rationale behind this technique contends that a portfolio. By combining our equity underlying hedge and income components we believe the DRS is a better way of implementing a truly diversified strategy.

Risk Reward for Portfolio 1. See how a proactive investment approach can be tailored for you. Ad Live hands-on investing workshop that will forever change how you look at the market.

The variability of returns on a portfolio is. A common path towards diversification is to reduce risk or. Portfolio theory is an excellent tool for investment advisers to use when determining the degree of diversity required for a.

Rowe Price Helps You Meet Clients Financial Goals. Ad Well Help Build The Financial Plan And Investment Strategy You Need Based On Your Goals. Diversify with insurance-linked investments using Vesttoos proprietary technology.

Ad Sign up for a Consultation to Answer Specific Questions About Portfolio Diversification. Learn More About How T. The formula for portfolio variance is given as.

Portfolio diversification explains the two-way flow of capital between countries even when interest rates are equalized among countries. Ad A client-first approach to institutional investing. Diversification is apparent in the increase of the diversi-fication quotient from two to three.

Diversification is a risk management technique that mixes a wide variety of investments within a portfolio. Learn More From One of Our Trusted Financial Advisors Today. Visit The Official Edward Jones Site.

Diversification is a technique that minimizes portfolio risk by investing in assets with negative.

Tactical Asset Allocation Beware Of Geeks Bearing Formulas

The Portfolio Diversification Effect Youtube

Business Banking Management Marketing Sales Risk Management In Banking The Effect Of Diversification On Portfolio Value

Portfolio Diversification How To Diversify Your Investment Portfolio

Time Diversification Redux Research Affiliates

Investment Analysis And Portfolio Management Lecture 3 Gareth Myles Ppt Download

Business Banking Management Marketing Sales Risk Management In Banking The Effect Of Diversification On Portfolio Value

Finance Portfolio Variance Explanation For Equation Investments By Zvi Bodie Quantitative Finance Stack Exchange

Solactive Diversification The Power Of Bonds

Portfolio Diversification How To Diversify Your Investment Portfolio

Standard Deviation And Variance Of A Portfolio Finance Train

Portfolio Returns And Risks Covariance And The Coefficient Of Correlation

Diversification

Asset Allocation And Diversification Chartschool

:max_bytes(150000):strip_icc()/ModernPortfolioTheory1_2-8e6110a86b02462c89b401a46ad2118f.png)

Modern Portfolio Theory Why It S Still Hip

/ModernPortfolioTheory1_2-8e6110a86b02462c89b401a46ad2118f.png)

Modern Portfolio Theory Why It S Still Hip

Modern Portfolio Theory 2 0 The Most Diversified Portfolio Seeking Alpha